List of all tier 1 banks in Kenya

Fresh in the minds of Kenyans is the dramatic fall of Chase Bank in 2016 which sent scores of customers into a withdrawal frenzy.

The bank which was later found to have been defrauded by senior officials brought to light financial safety concerns across Kenyan banks.

As you consider various banking options for your cash and savings, these are the safest top-tier banks in Kenya;

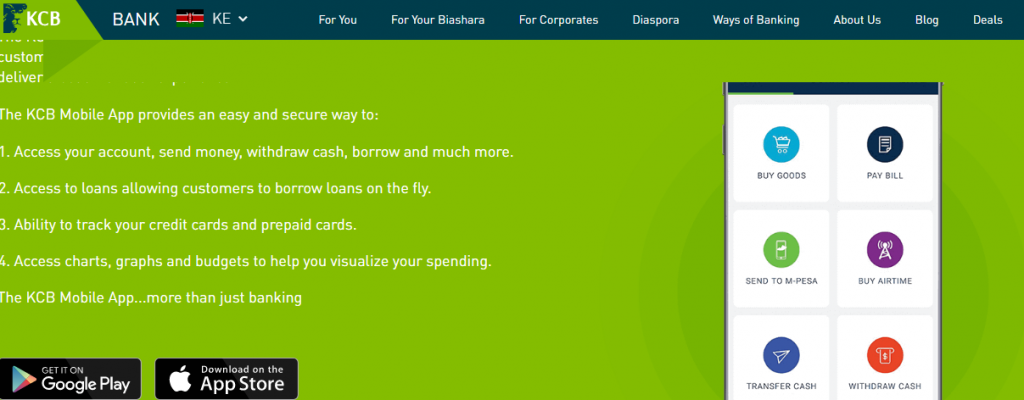

1. Kenya Commercial Bank (KCB)

-

- KCB is registered as a commercial bank by Kenya’s regulator Central Bank of Kenya (CBK).

- The bank boasts a Ksh. 939.6 billion asset base and a reach of 205 branches countrywide.

- It has since crossed over Kenya’s borders with operations in Uganda, Tanzania, South Sudan, and Burundi.

- Kenya Commercial Bank also has over 29 million Kenyan customers, as well as 26,726 agents countrywide.

- Alongside other top banks, KCB controls close to half of Kenya’s market share.

- KCB provides distinct services for both individual and corporate utility.

- The services include;

-

- Loans

- Insurance

- Savings

- Financing

-

- Its popular KCB-MPESA service has enabled millions of users to save and borrow loans from it.

- KCB has also digitized its services and is now accessible on the world wide web and KCB Applications.

- Click here to download the KCB Android mobile App.

- Click here to download the KCB iOS mobile App.

Also read: List of countries and their airlines and IATA codes

2. Equity Bank Kenya

-

- Equity Bank Kenya Limited is a financial services provider headquartered in Nairobi, Kenya.

- It is licensed as a commercial bank by the Central Bank of Kenya which is Kenya’s banking regulator.

- Alongside other top banks, Equity controls close to half of Kenya’s market share.

- Equity is also the most accessible bank in Kenya complete with Mtaani agents as well as User SIM cards.

- Mimicking Safaricom’s M-PESA, Equity Bank customers can perform deposits, withdrawals, and a host of other transactions using the convenient Equitel line.

- After being introduced in 2014, Equity Bank’s mobile network Equitel attracted more than 2.7 million users in just 2 years.

- This cutting-edge banking maneuver grew Equity Bank’s market share to 20%.

- By 2021, Equity Bank had an asset base of over Ksh. 1.12 trillion.

- Equity Bank has also digitized its services and is now accessible on the world wide web and Equity Bank Applications.

- Click here to access the online Equity Bank self-service portal.

- Click here to download the Equity Bank Mobile App.

3. Co-operative Bank of Kenya (Co-op Bank)

-

- Co-operative Bank of Kenya is a registered commercial bank in Kenya, the largest economy in the East African Community.

- It is licensed by the Central Bank of Kenya which is the national banking regulator.

- The bank was listed on December 22nd, 2008 using collective shares of 3,805 Co-operative Societies and unions.

- Co-op has a subsidiary, Kingdom Securities Limited which is a stockbroking firm. The bank owns 64.56% of Kingdom Securities.

- Co-operative Bank offers a wide array of financial services including;

-

- Banking for businesses

- Individual banking

- Banking for co-operatives

- Banking for Institutions

- Investor services

-

- Co-op Bank has also digitized its services and is now accessible on the world wide web and mobile banking.

- Click here to download the Co-operative Bank mobile App.

Also read: A list of All Mobile Loan Apps in Kenya

4. Standard Chartered Kenya (Stanchart Kenya)

-

- Standard Chartered PLC is a British multinational bank that offers retail banking in Kenya.

- Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya.

- The bank offers individual consumer, corporate, institutional banking, and treasury services.

- Its first branch in Kenya was opened at Treasury Square in Mombasa’s Central Business District.

- The bank has also been on a recent winning streak of banking awards, having won accolades including;

-

- World’s Best Trade Finance Provider in Kenya 2022

- Best Trade Finance Bank in East Africa 2022

- Best Consumer Digital Bank 2020

-

- Standard Chartered Bank Kenya has also digitized its services and is now accessible on the world wide web and Standard Chartered Bank Applications.

- Click here to download the Stanchart Kenya mobile App.

5. Stanbic Bank

-

- Stanbic Holdings Plc, formerly known as CfC Stanbic Holdings Limited, is a financial services organization in Kenya.

- Headquartered in Nairobi Kenya, Stanbic Bank has subsidiaries in Kenya and South Sudan.

- Alongside other top banks, Stanbic controls close to half of Kenya’s market share.

- The bank has been serving Kenyans since 1958, with a wide range of products including;

-

- Private banking

- Diaspora banking

- Construction Financing

- Salary or cash advance

- Loans including home loans

- Mobile banking

-

- Click here to download the Stanbic Bank Mobile App.

Also read: List of All Taxi Hailing Apps in Kenya

6. Absa Bank Kenya

-

- Absa Bank Kenya PLC, formerly Barclays Bank Kenya Limited, is a commercial bank registered in Kenya.

- The bank is a subsidiary of the South Africa-based Absa Group Limited.

- It is licensed by the Central Bank of Kenya, the central bank and national banking regulator.

- Absa Bank is present in 12 countries offering financial services including;

-

- Personal Banking

- Islamic banking

- Corporate investment

- Insurance

- Asset management

-

- Absa has a popular money lending service Timiza that is ideal for low-income earners.

- The service is accessible through both USSD and online mobile Apps.

- Click here to download the Absa Bank Mobile App.

- Click here to download the Absa Bank iOS Mobile App.

7. NCBA Bank

-

- NCBA is a major player in Kenya’s banking sector.

- It was formed in a highly publicized 2019 merger between heavyweights NIC Bank and the Commercial Bank of Africa (CBA).

- Headquartered in Nairobi Kenya, NCBA Bank has subsidiaries in the following countries;

-

- Uganda

- Tanzania

- Rwanda

- The Ivory Coast

-

- The NCBA Bank Kenya offers a wide range of financial services including;

-

- Current and savings accounts

- Diaspora banking

- Forex solutions

- Home and plot loans

- Asset finance (car and logbook loans)

- Personal loans

- Overdrafts

- Insurance services for cars, homes, health, critical illness, and personal accident, among others.

- Investment services

-

- Alongside other top banks, NCBA Bank controls close to half of Kenya’s market share.

- NCBA offers cutting mobile banking options to its customers featuring a functional online self-service portal and mobile Apps.

- Click here to download the NCBA Kenya Android App on Google Play Store.

- Click here to download the NCBA Bank Kenya iOS App.