Top 3 online payment platforms in Kenya

Key takeaways

-

- Kenya is experiencing steady digital growth, marked by greater usage of smart gadgets than ever before.

- The digital economy requires payment instruments capable of managing the increasing number of online transactions.

- A variety of online payment platforms have emerged to fill this gap, by providing faster and effective transactions through the internet.

- This article introduces the top five mobile payment platforms in Kenya.

Also read: A list of All Mobile Loan Apps in Kenya

1. iPay

-

- iPay is a Kenyan online payment platform designed to simplify payment processes.

- Regulated by the Central Bank of Kenya, iPay also serves individuals and businesses in the following African countries:

-

- Uganda

- Tanzania

- Rwanda

- Burundi

- Nigeria

- Zambia

- Malawi

-

- iPay has enjoyed progressive growth over the years, culminating in the Gold Award for Payment Processing Platform of the Year E-Commerce Award 2022.

- Click here to register an iPay account and access the iPay payment solutions.

iPay online payment solutions

-

- iPay personal service is a payment solution that enables you to effortlessly make or receive payments through your smartphone or computer.

- iPay also has a business solution package that is designed for the following customers:

-

- Commercial traders and merchants

- Religious organizations

- Donor funded organizations

-

- Click here to register an iPay account and access the iPay payment solutions.

iPay personal service

-

- The iPay personal service package mainly assists you in settling your bills without breaking a sweat.

- Through an iPay mobile App, for instance, you can pay for the following common bills:

-

- TV subscriptions including Zuku, DSTV, and GoTV.

- You can also buy airtime for mobile use through iPay.

-

- The wonderful aspect is that through iPay, you can pay through multiple payment methods including:

-

- M-PESA

- Equity Mobile Money

- VISA

- MasterCard

- Amex

- Vooma

- Union Pay

- PesaLink

-

- This makes iPay one of the most convenient payment processing platforms in Kenya.

TV subscriptions including Zuku, DSTV, and GoTV.

iPay business solutions

-

- iPay has a competitive package for businesses and traders designed to streamline dealings with employees, suppliers, and partners alike.

- The iPay business solutions include:

-

- iPay Bulkpay enables you to transfer payments to employees or suppliers easily.

- iPay POS service makes it easy for your business to receive payment from numerous people including clients.

- Tickets4U offers a streamlined solution for creating, selling, distributing, and tracking ticket sales. – This helps you register your event online, and manage your events and ticket sales.

-

iPay mobile App

Click here to download the iPay mobile App.

iPay customer care contacts (+254 791 444 111)

-

- Click here to visit the iPay Africa Facebook page.

- iPay email: info@ipayafrica.com

- Click here to visit the iPay Africa X page.

- iPay helplines: +254 791 444 111, +254 734 441 111

- Click here to visit the iPay Africa LinkedIn page.

- iPay WhatsApp line: +254713129623

2. M-PESA

-

- Developed by Safaricom, a telecommunications giant, M-Pesa stands as one of Africa’s most successful mobile payment networks.

- M-PESA is an excellent digital success in Kenya, credited for revolutionizing the country’s financial economy.

- M-PESA has widened its coverage to the rural and remote parts, making it the biggest technological phenomenon ever witnessed in Kenya.

- M-PESA has expanded to other African countries including:

-

- Tanzania

- Mozambique

- The Democratic Republic of Congo

- Ethiopia

- South Africa

-

M-PESA online payment features

-

- M-PESA is among the limited number of mobile money platforms in Africa facilitating cross-border international payments.

- M-PESA facilitates payment of bills such as power bills, product purchases in shops and retail shops, as well as buying airtime for mobile use.

- M-PESA has also expanded its product portfolio by introducing loan services. You can easily access a quick loan through the App or its Mobile Toolkit version.

M-PESA mobile App

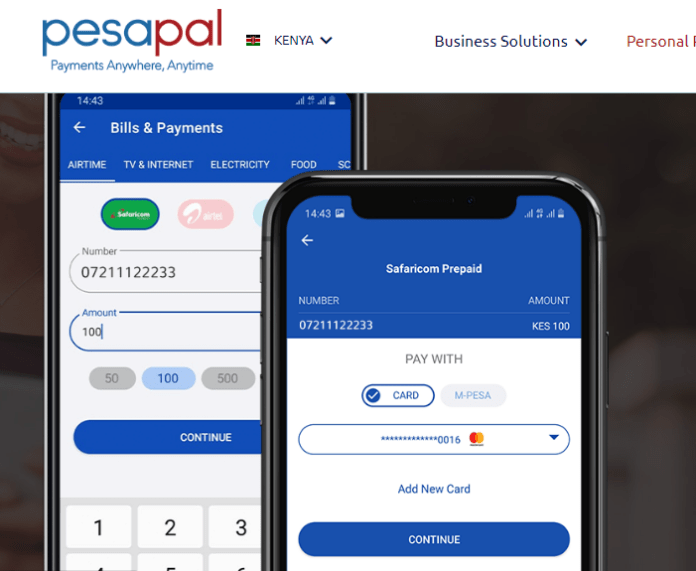

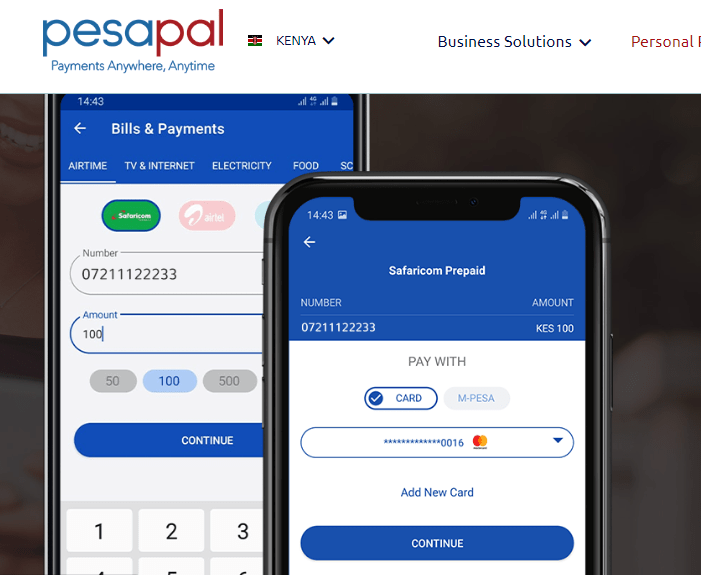

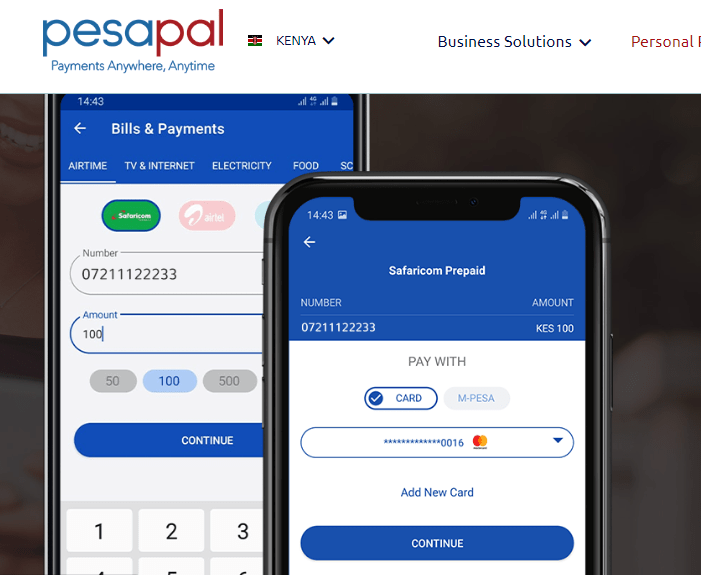

3. Pesapal

-

- The Pesapal Mobile app is a premier lifestyle application designed to help you conveniently pay all your bills in bulk with a single transaction.

- Pesapal’s services have also crossed Kenya’s borders and can be accessed in the following African countries:

-

- Tanzania

- Malawi

- Uganda

- Zambia

- Zimbabwe

-

Pesapal online payment solutions for businesses

-

- Pesapal makes it easy for your business to receive payment from numerous people including clients.

- Using the Pesapal app, customers can efficiently handle bulk payments such as utility bills including house rent and power tokens.

- Pesapal has a special fuel management service that allows petrol station staff and managers to:

-

- Conduct real-time monitoring of transactions and payments.

- Automate end-to-end processes.

-

Pesapal personal payment solutions

Pesapal allows you to perform the following financial operations at a personal level:

-

- Pesapal makes it easy for you to process payments and buy airtime via M-PESA through pay bill number 220220.

- You can buy credit in Kenya for Safaricom, Airtel, and Telkom online with VISA or Mastercard Pay through 220220. Your account number is your phone number.

- Pay your TV, Internet, and Electricity bills on your mobile or online with mobile money or your debit/ credit card through PesaPal.

Pesapal payment methods

Pesapal accommodates different payment options for transactions. This gives users an array of options to choose from, thus ensuring much-needed flexibility.

The Pesapal-supported payment methods include:

-

- VISA

- MasterCard

- M-PESA

Pesapal Kenya contacts

-

- Pesapal Kenya helpline: +254 709219000

- Pesapal Kenya email: info@pesapal.com

Pesapal Mobile Apps

Also read: List of All Taxi Hailing Apps in Kenya

With the impressive uptake of technology in the country, Kenyan techies have risen to the occasion to craft customized financial solutions for individual and commercial use.

The online payment solutions particularly iPay and M-PESA have proved formidable, attracting interest from other African countries.

Simplified access to finance transfer services has also played a pivotal role in ensuring ease of business, making Kenya the region’s economic magnet.

Do you have any news or article you would like us to publish? Kindly reach us via outreach@t4d.co.ke or howtodoafrica@gmail.com.